Taxes are quite annoying – especially income tax as it directly takes away from your hard-earned money. Unfortunately, there is no way to avoid paying federal income tax. It is, however, possible not to pay state income tax – if you live in a state with no income tax.

There are several states in the US that don’t have income tax – and moving to one of these states sounds like a very good idea. Every year, more and more Americans are relocating to states with zero income tax, hoping to reduce their overall tax obligation – and, thus, to keep more money in their wallets.

While not having to pay income tax certainly boosts take-home pay, however, there’s usually a trade-off – states without income tax often have higher sales or property taxes and more expensive or lower quality public services.

So, if you’re thinking about moving to a state with no income tax, you need to understand how things work there first – and how it will affect you and your family.

Here is everything you need to know in order to make an informed decision about moving to an income-tax-free state:

Which states have no income tax?

Most states in the US levy a tax on income – some have a flat-rate income tax, while others have graduated rates based on income levels. The revenue from income taxes is used to fund public services such as transportation, health care, and public education.

There are a few states, however, that try to attract talented workers, draw new businesses, create jobs, and retain young people by cutting the income tax.

So, how many states don’t have income tax and which are they?

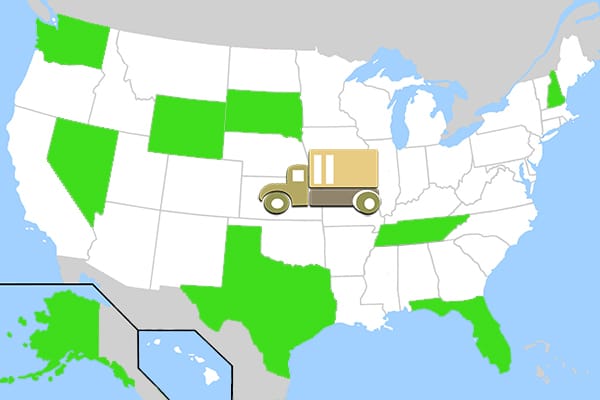

As of February 2021, there are eight states with no income tax whatsoever – Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington, and Wyoming. There is also one state – New Hampshire – that doesn’t require residents to pay tax on earned income, but levies taxes on dividends and income from investments.

Pros and cons of moving to a state with no income tax

Moving to a state with no income tax seems like a smart financial decision – if you live in a place where earnings are not taxed, you will be able to keep more of your paycheck. This, however, doesn’t necessarily mean that your financial situation will improve. As beneficial as living in a state without income tax may be, it’s not without its pitfalls.

Benefits of moving to an income-tax-free state

The biggest advantage of moving to a state with zero income tax is quite obvious – you don’t have to pay state tax on your income, so you get to keep more of your hard-earned money. This is especially beneficial if you have a higher income.

In most states, income tax is based on a bracketed system with different rates applicable to people with different income levels, meaning that higher earners pay higher taxes. In a state without income tax, however, high earners won’t have to pay any income tax at all – so they will be able to save much more of their money.

People with lower income will also keep more of their paycheck, of course, but the difference in their take-home pay won’t be so substantial.

According to recent reports, over the past decade the nine income-tax-free states have consistently outperformed all other states in terms of GDP growth, employment growth, and in-state migration.

Related: Top 7 factors to consider when deciding where to move next

Drawbacks of moving to a state with no income tax

States that don’t have income tax need other sources of revenue in order to fund public services – so, they usually raise other taxes. They also tend to provide lower quality services and more expensive higher education.

Texas and New Hampshire, for example, have exceptionally high property taxes. Tennessee has one of the highest sales tax rates in the country and Washington charges extra on groceries and gasoline.

So, if you move to a state with no income tax, you’ll be paying more for housing, goods, and services – and even though you’ll keep more of your income, you may not be able to save more of your money. The amount you’ll be paying toward sales and property taxes could, in fact, be higher than the amount you would pay toward taxes overall in a state that has an income tax.

It’s also very important to note that sales taxes don’t change depending on the income level of the consumer – everyone pays the same tax, regardless of how much money they make. This places an inequitable burden on lower earners who need to devote a big chunk of their take-home pay to buying things that are subject to sales taxes. Wealthier people are much less affected by sales taxes, as they spend a much smaller proportion of their income on living expenses.

So, if you don’t make much money, moving to a state with no tax income may not be beneficial for you at all. And if you’re moving without a job, it may be difficult to find employment in your new area, since job growth lags behind population growth in most zero-income-tax states.

On top of it, you may need to pay more for education and other public services or the provided services may not be good quality.

Good to know: Keep in mind that even if you move to a state with no income tax, your earnings may still be taxed:

- If you make money from a business that’s located in a state with income tax, then you will still be liable for income tax in that state;

- If you spend too much time in another state (more than 183 days), you won’t be treated as a resident of the income-tax-free state you’ve set up your new home in and will, therefore, have to pay tax.

Should you move to a state with no income tax?

So, considering all of the above, is it a good idea to move to a state with no income tax or not? It depends on the specific circumstances in your case – your income level, yours and your family’s needs, your spending habits, etc.

Moving to a zero-income-tax state is a great option for people who:

- Have a high income – as explained above;

- Rarely use public services – If you don’t rely on public healthcare, don’t use public transportation, don’t have children (or send your kids to private schools), etc., the fact that the public services in your new income-tax-free state may not be good quality won’t affect you much;

- Don’t own a lot of property – If you don’t have a fancy house or a big plot of land, the high property taxes in the states with no income tax won’t be an extra burden for you;

- Don’t have a high consumption lifestyle – If you’re not a big spender, you may be able to save more of your money when living in a state with zero income tax.

How to move to a state with no income tax

If you’ve decided that moving to a state with no income tax is the right step for you, you need to prepare properly for the big endeavor:

- Research the zero-tax-income state you consider moving to in detail – Gather as much information as possible about the employment opportunities, real estate market, cost of living, climate, safety, cultural peculiarities, state services, and state taxes in your prospective new state;

- Check what you need to do to be considered a resident of your chosen new state -You’ll typically need to establish both state residency and domicile. Residency and domicile requirements vary by state, but usually, you have to spend a certain amount of time in the state in order to call it your state of residency – and you need to change some of your documents to reflect your new address (your voter registration, driver’s license, bank accounts, etc.). In order to enjoy an income-tax-free life, you also need to make sure that you’ve done everything necessary to free yourself from tax obligations in your previous state (See also: How to change your address when moving; What documents to change when moving);

- Plan your move – Make a moving calendar, set up a moving budget, sort out your belongings and get rid of unneeded items, make a moving inventory, and pack your possessions in a safe and efficient manner. (See also: How to prepare to move out of state);

- Hire professional movers – When moving to a state with no income tax, yours will be an interstate move – it will be difficult to organize and even more difficult to perform. Your best bet is to use professional moving services – the experienced movers will take care of everything and will ensure your smooth and successful relocation experience. Just be sure to find reliable moving partners to work with – ask for recommendations, read moving company reviews, check movers’ ratings, get in-house estimates from three or four reputable companies, compare their offers, verify their licensing and insuring information, check their complaint histories, and choose the best state-to-state mover for you. (See also: How to find good movers)

People with higher incomes benefit the most from moving to a state with no income tax, but living in such a state may prove advantageous to you, regardless of your current earnings. Just make sure you understand the situation in your prospective new state correctly (not only the state taxes, but also the overall economic and social scene and the opportunities you will – or won’t – have if you live there) and make the right decision for you and your family.